Introduction

The use of credit facilities is a nearly indispensable tool for the enhancement of business activities. Smith captures it more as follows:

“Commerce and investment are the lifeblood of any economy. Financing these major economic activities requires the use of credit facilities by individual entrepreneurs, corporate entities, small and large scale industries and multinationals many of whom source capital largely from borrowing. Banks and other financial institutions provide the tonic for the vigorous commercial activities through lending. The provision of credit facilities is an investment for banking and a method of financial undertaking which propels economic growth.”

(I. O. Smith, Nigerian Law of Secured Credit, (Ecowatch Publications: Lagos, 2001) p. 1.)

One of the greatest challenges financial institutions face in providing credit facilities is the failure of borrowers to repay. This generally informs the insistence on security (collateral). In some genuine cases, the failure to repay could be triggered by unfavourable business ventures, government policy, lack of enabling environment for business to thrive, force majeure (act of god), etc. It is also common knowledge how financial institutions use illegal and hidden charges to keep their debtors perpetually indebted.

However, many a time, businessmen and women have found a smart way of avoiding their obligations to financial institutions by failing to repay their indebtedness. In some other cases, we have seen deliberate act of refusal to repay. This might sometimes be through diversion of funds for personal purposes and gains, instead of using credit obtained for the purpose for which the funds were advanced. When such development arises, the borrower sometimes employs all available means to frustrate the bank including filing of frivolous suits, in abuse of court process. This kind of approach has proved harmful to some financial institutions as we shall see below.

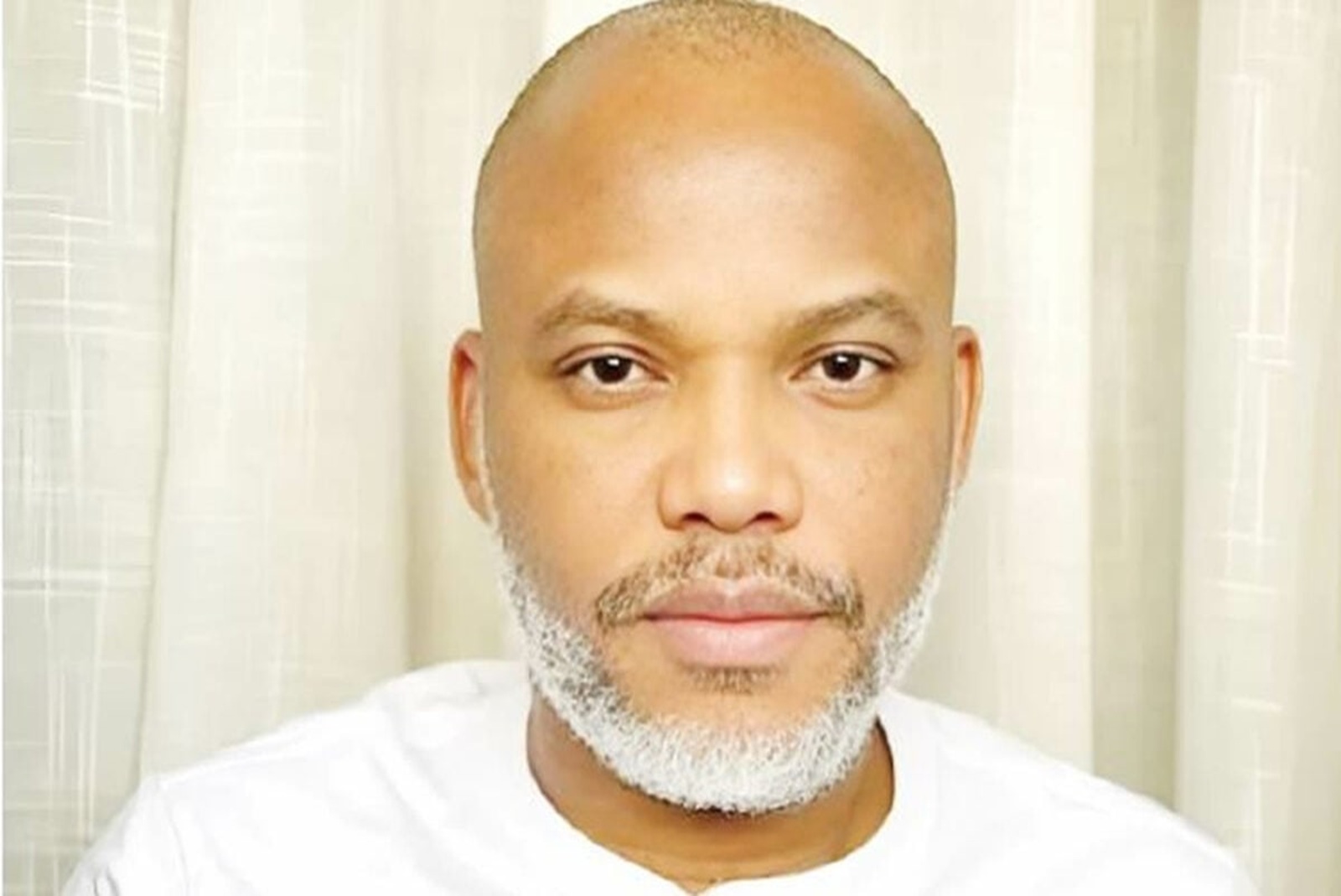

Tilley Gyado & Co. (Nig.) Ltd. v. Access Bank Plc

The case of Tilley Gyado & Co. (Nig.) Ltd. v. Access Bank Plc [2019] 6 NWLR (Pt. 1669) 399 presents us with a classic example. At pages 443-444, paras. E-D of the report, Hon. Justice Abiru, JCA gave a precise narrative of what transpired, leaving us with a seminal presentation on how to preserve honour in business. His Lordship censured Sen. Jacob Tilley-Gyado for his role in wrecking the defunct Intercontinental Bank Plc. The statement is worth quoting in full. Hear him:

“This Court must say that this case leaves a slightly bad taste in the mouth. The Second Respondent, Senator Jacob Tilley-Gyado, is supposedly a respectable and honourable man and a leader of thought in his community. He approached the First Respondent (Access Bank Plc) through the instrumentality of the Appellant (Tilley Gyado & Co. (Nig.) Ltd.) for an overdraft facility of N80 Million to finance a contract and he personally signed the requests for the overdraft, Exhibits A, C and E. The First Respondent granted the requests on terms and conditions agreed to and personally accepted by the Second Respondent on behalf of the Appellant by signing Exhibits B, D and F, and the money, N80 Million belonging to other customers of the First Respondent, was disbursed to him. The facility was for a period of ninety days with effect from June, 2008 and it was personally guaranteed and collateralized by the Second Respondent; Exhibit G was the Personal Guarantee. The Second Respondent signed the letter addressed by the Appellant to the First Respondent wherein the Appellant acknowledged that it was indebted to the First Respondent on the overdraft facility, Exhibit H. The Second Respondent thus had personal knowledge of the overdraft facility, of the terms and conditions of the facility and the fact that the Appellant is yet to repay the facility.

One of the agreed terms of the facility was that the payments from the contract to be executed with the funds would be domiciled in the account with the First Respondent to liquidate the facility and interests due thereon. However, as admitted by the Appellant in a paragraph of the pleadings it filed in Suit No. PLD/J244/2009, when payments on the contract were made, they did a dishonourable and irresponsible thing; they diverted contract payments in the sum of N78,866,044.78 from the account with the First Respondent, in clear breach of their undertaking and agreement.The overdraft facility has been due for repayment for over ten years now and the Appellant and Second Respondent have not stated anywhere in the processes filed in this matter that they have paid up or taken steps to pay up the facility, not even the principal sum of N80 Million collected. Rather they have engaged in going from court to court to prevent the First Respondent, and now the Third Respondent (AMCON), from enforcing the repayment of the facility. This is definitely not right and there is no credibility, honour or respect in such actions.

Credibility, honour and respect lie in a man standing up and staying committed to his obligations and undertakings and finding ways of meeting them, even in difficult times. It is common knowledge that Intercontinental Bank Plc, the initial bank that entered into the transaction with the Second Respondent, suffered a distress that led to its take-over and decimation and to some innocent investors in the Bank losing their money. Meanwhile, customers/debtors like the Second Respondent and the Appellant, who contributed to the distress of the Bank, are strutting around the court rooms with no intention of repaying their debts and seeking to use the processes of court to perpetuate their impunities. Any society that permits and condoles such actions cannot flourish and its citizens will be impoverished by persons they look up to and to whom they have ceded the responsibility of improving their lot. Ways and means must be developed to curb such behaviors and actions.”

I have nothing more useful to add!