A. Introduction

On March 23, 2020, the Central Bank of Nigeria (“The CBN”) in an effort to mitigate the negative economic impact of the COVID-19 on households, micro, small and medium scale enterprises, released the Guidelines for the Implementation of the N50 Billion Targeted Credit Facility (“The Guidelines”). The only participating bank – NIRSAL Micro Finance Bank (NMFB), will utilize the Guidelines in the processing and granting of loans to eligible applicants. While this is laudable and follows the practice of many other countries in Asia, Europe and America, there are major gaps in the Guidelines that would likely defeat the overall aim and objectives of the monetary intervention.

B. A few of Nigeria’s problems

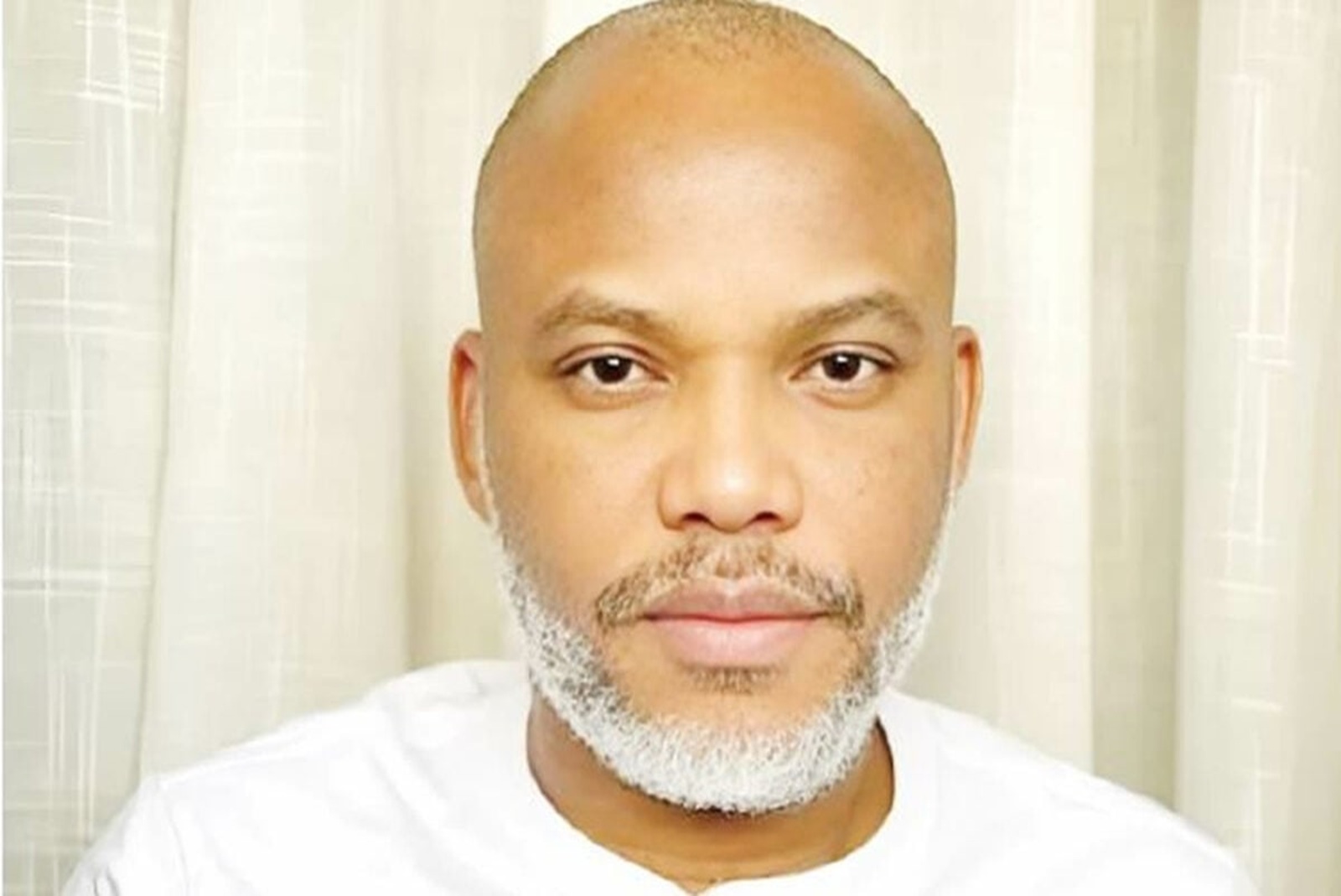

Nigeria is a country of over 170 million people, living in 36 states and the Federal Capital Territory, Abuja (FCT) with only 35% of them having bank accounts. In 2017, the Minister of Education revealed that out of the 170 million people, about 70 million of them are illiterates. Apart from tribal and religious differences that impede the country’s progress on a daily basis, it is a common knowledge that corruption is a major debilitating factor in Nigeria’s public governance.

C. Some of the gaps in the Guidelines

1. The participating financial institution and its ownership composition

The Guidelines nominated the NIRSAL Micro Finance Bank (NMFB) as the only financial institution that is eligible to receive loan applications, process, and recommend to the CBN for approval. It is interesting to note that the ownership structure of the NMFB is as follows: 50% of its equity is owned by the Bankers’ Committee, 40% by NIRSAL (Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL Plc.) and 10% by NIPOST. NIRSAL is completely owned and controlled by the CBN, while the Bankers Committee is described to mainly comprise of the CBN and Chief Executive Officers of Nigerian banks. It is not clear how the Bankers’ Committee, not deemed a person at law, can be capable of owning equity in the NMFB, which was established in 2019, with little operational experience and staff capacity to process the loan applications from several millions of Nigerians and businesses that have been impacted by the COVID-19.

Based on CBN’s data, Nigeria has over 898 micro finance banks. It is therefore not clear why the CBN nominated only one bank to process and disburse the N50 Billion credit facility, considering the need to speedily process applications, disburse and stimulate the economy so as to prevent it from experiencing a severe economic recession.

As most of the 36 states and FCT are in either a full or partial lockdown, with movements restricted and strictly enforced, it is also not clear how eligible Nigerians MSMEs are expected to submit the loan applications given that the Guidelines does not contain any email address of the NMFB via which the loan applications can be sent or how to exactly submit applications. Given that about 64% of Nigerians live in rural areas, with very limited access to electricity and internet, and with about 40% illiteracy rate, the most impacted households and micro businesses will eventually be left out in the CBN loan facility.

2. The Guidelines stipulates onerous requirements for the loan application

The N50 Billion credit facility is an intervention fund which targets to mitigate economic hardships on households and MSMEs impacted by the COVID-19. Granted that it is a public fund and the CBN ought to ensure against any loss of it, the primary aim and objectives of the fund should however not be defeated by the requirements for eligibility. For example, the Guidelines requires individuals to amongst other requirements, furnish an acceptable collateral that is worth 70% of a loan sum, and also furnish a recent utility bill, both for the loan applicant and their guarantor. This is problematic considering that the households that are seriously impacted may not have collateral worth 70% of a requested loan sum and may not be living in their own homes as to have utility bills in their names. Many Nigerians living in urban areas, live as tenants, while the 64 percent living in rural areas do not have well defined addresses, and do not receive any utility bills.

Another challenge is that for the MSMEs, they are required by the Guidelines to provide a life insurance of the Key-Man/promoter of business, and a comprehensive insurance cover for the asset-collateral they provide, in which they the NMFB will be named as the First Loss Payee. In Nigeria, the average cost for a comprehensive insurance for private motor vehicles is about N150,000 per annum, and given the current uncertainties, insurance companies will charge higher premiums, which would generally be unaffordable by the impacted demographics.

3. Lack of transparency in the disbursement process

Based on data, Nigeria is a significantly corrupt country, and corruption is a major problem in the country’s public institutions, which has whittled the level of confidence in public governance. The Guidelines contain many gaps that could be exploited to defeat the primary aim and objectives of the Targeted Credit Facility. First, it nominated only one bank for which it has massive equity to hold the N50 Billion facility for a period of 4 years – until December 2024. The NMFB was recently established and does not have experience and capacity to handle millions of loan applications at a time. Second, it is not feasible that the several millions of Nigerians can send loan applications to one processing bank via email or physical submissions, especially where the NMFB has only one known branch in Abuja.

Third, given that the credit facility ought to be sprinkled across the country, there is no indication on how the intervention fund will be allocated to households and businesses across the 36 states and FCT. Fourth, considering that the credit facility is a public fund, there is no mention by the CBN on whether how and when it will publish the names of the beneficiaries and their locations; as it stands, at the end of 2024, there will be no way to know if anyone was granted any loan at all.

Fifth, given the heightened level of corruption in the country, it is possible that the individuals or companies that would be eligible to access the fund, will be ghost individuals and paper companies that are not in any active businesses; they will access the loans at 5% per annum as stipulated by the Guidelines, and could fix-deposit it at the prevailing commercial bank rate for profit. In egregious cases, they may not repay the loans, and the CBN would deem same as non-performing assets. These are possibilities, and had happened in the past under the AMCON experience.

D. Recommendations

a) The CBN should nominate more participating banks across the country for easy access of the loan, and transparency in processing and disbursement. Also, the requirement to have CBN approve every disbursement is not feasible and necessary, considering the potential millions of qualified applicants, whose applications would have to pass through the CBN.

b) There is no need to be secretive in the identities of the beneficiaries, given that the N50 Billion credit facility is a public fund, and the general public has the right to know the persons who benefitted from the fund. Thus, the CBN should undertake to publish the names of Nigerians and businesses that were approved for the loans and the amount each of the recipients got.

c) Given that the fund is a stimulus package meant to generally stimulate the economy, the disbursement should be evenly spread across the various kinds of businesses that are listed in the Guidelines. Also, the CBN should periodically publish the names and locations of the beneficiary individuals and businesses.

d) The Guidelines only targets to assist the 35% of Nigerians with bank accounts, given that it requires their bank verification numbers (BVN) as a requirement for the loan application. It is uncertain how the CBN plans to reach out to the unbanked demographic who might be more impacted by the COVID-19.

e) Similarly, since the N50 Billion intervention fund only seeks to assist 35% of Nigerians, a better approach would have been to remove the recent CBN stamp duty fee which became effective on April 1 2020, and entails a N50 charge on all deposits above N10,000. Also, the various applicable charges on POS transactions, ATM withdrawal charges, mobile app transfer charges, etc., would have been a more direct benefit to Nigerians, than the N50 Billion credit facility whose primary aim would likely be defeated by corruption and lack of transparency in the disbursement.

E. Conclusion

The CBN N50 Billion credit facility, is in principle, a necessary stimulant to the economy that is already battling with the economic impacts of the COVID-19. Many other countries have created a similar monetary intervention and are being transparent about it. However, Nigeria has a bad history of misappropriation of public funds, and there is no guarantee that the N50 Billion will be exempt from mismanagement.

Recently, the office of the Account-General of the Federation was gutted by fire, and later, it is possible to hear that some sensitive financial records were destroyed as a result. When Nigerians demand for accountability for the various funds disbursed to respond to the COVID-19, the fire incident might be a good excuse for any record or document declared to be missing.

If the CBN wishes to stimulate the economy with N50 Billion, they can explore some of the recommendations above.

References

[2] https://www.premiumtimesng.com/news/more-news/243820-75-million-nigerians-illiterate-fg.html

[3] Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL Plc.)

[4] https://nmfb.com.ng/about/

[5] https://www.cbn.gov.ng/Supervision/Inst-MF.asp

[6] https://www.getinsurance.ng/car-insurance-rates-in-nigeria/